Money

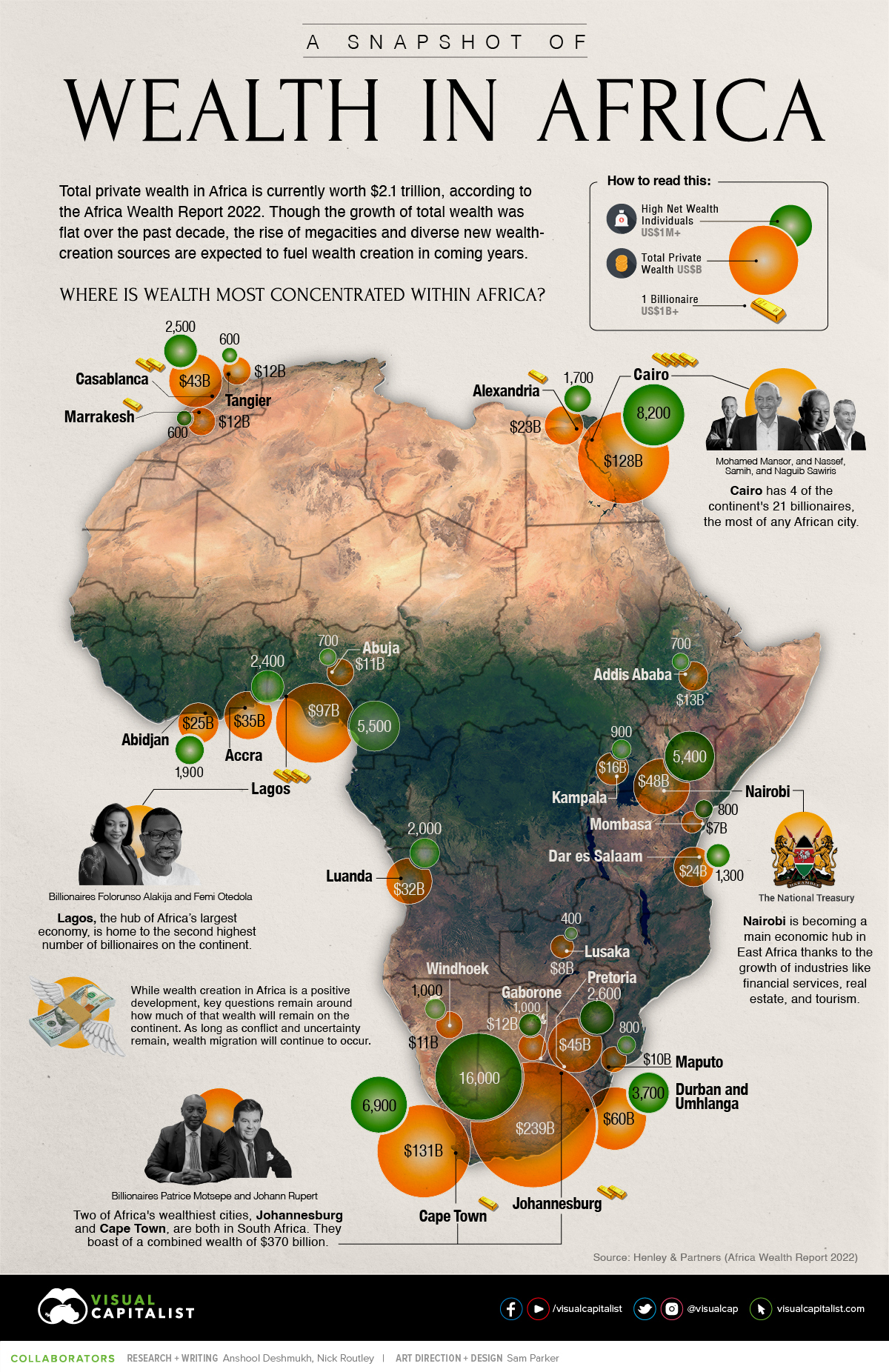

Mapped: A Snapshot of Wealth in Africa

Mapped: A Snapshot of Wealth in Africa

The continent of Africa contains more than 50 countries, but just five account for more than half of total wealth on the continent: South Africa, Egypt, Nigeria, Morocco, and Kenya.

Despite recent setbacks in Africa’s largest economies, wealth creation has been strong in a number of areas, and total private wealth is now estimated to be US$2.1 trillion. There also an estimated 21 billionaires in Africa today.

Drawing from the latest Africa Wealth Report, here’s a look at where all that wealth is concentrated around the continent.

A Country-Level Look at Wealth in Africa

South Africa is a still a major stronghold of wealth in Africa, with a robust luxury real estate market and ample wealth management services. The country is also ranked second on the continent in per capita wealth. That said, the country has faced challenges in recent years.

An estimated 4,500 high net worth individuals (wealth of US$1 million or more) have left South Africa over the past decade, migrating to places like the UK, Australia, and the United States. In one stark data point, the report points out that “there are 15 South African born billionaires in the world, but only 5 of them still live in South Africa.”

Here is how major African countries compare in terms of per capita wealth.

| Rank | Country | Wealth per Capita (US$) |

|---|---|---|

| #1 | 🇲🇺 Mauritius | $34,000 |

| #2 | 🇿🇦 South Africa | $10,970 |

| #3 | 🇳🇦 Namibia | $9,320 |

| #4 | 🇧🇼 Botswana | $7,880 |

| #5 | 🇲🇦 Morocco | $3,380 |

| #6 | 🇪🇬 Egypt | $3,000 |

| #7 | 🇬🇭 Ghana | $1,890 |

| #8 | 🇰🇪 Kenya | $1,700 |

| #9 | 🇦🇴 Angola | $1,620 |

| #10 | 🇨🇮 Côte d'Ivoire | $1,610 |

| #11 | 🇳🇬 Nigeria | $1,100 |

| #12 | 🇹🇿 Tanzania | $940 |

| #13 | 🇷🇼 Rwanda | $850 |

| #14 | 🇺🇬 Uganda | $820 |

| #15 | 🇿🇲 Zambia | $760 |

| #16 | 🇲🇿 Mozambique | $650 |

| #17 | 🇪🇹 Ethiopia | $540 |

Mauritius is Africa’s wealthiest nation on a per capita basis. Here are a few reasons why the island nation comes out on top:

- HNWI growth – Wealthy individuals have flocked to Mauritius in recent years

- Ease of doing business – Mauritius ranked 13th worldwide in World Bank’s Doing Business Report

- Low taxes – There is no inheritance tax or capital gains tax in the country

- Safety – Mauritius was recently rated by New World Wealth as the safest country in Africa

- Financial sector – A growing local financial services sector and stock market (SEMDEX)

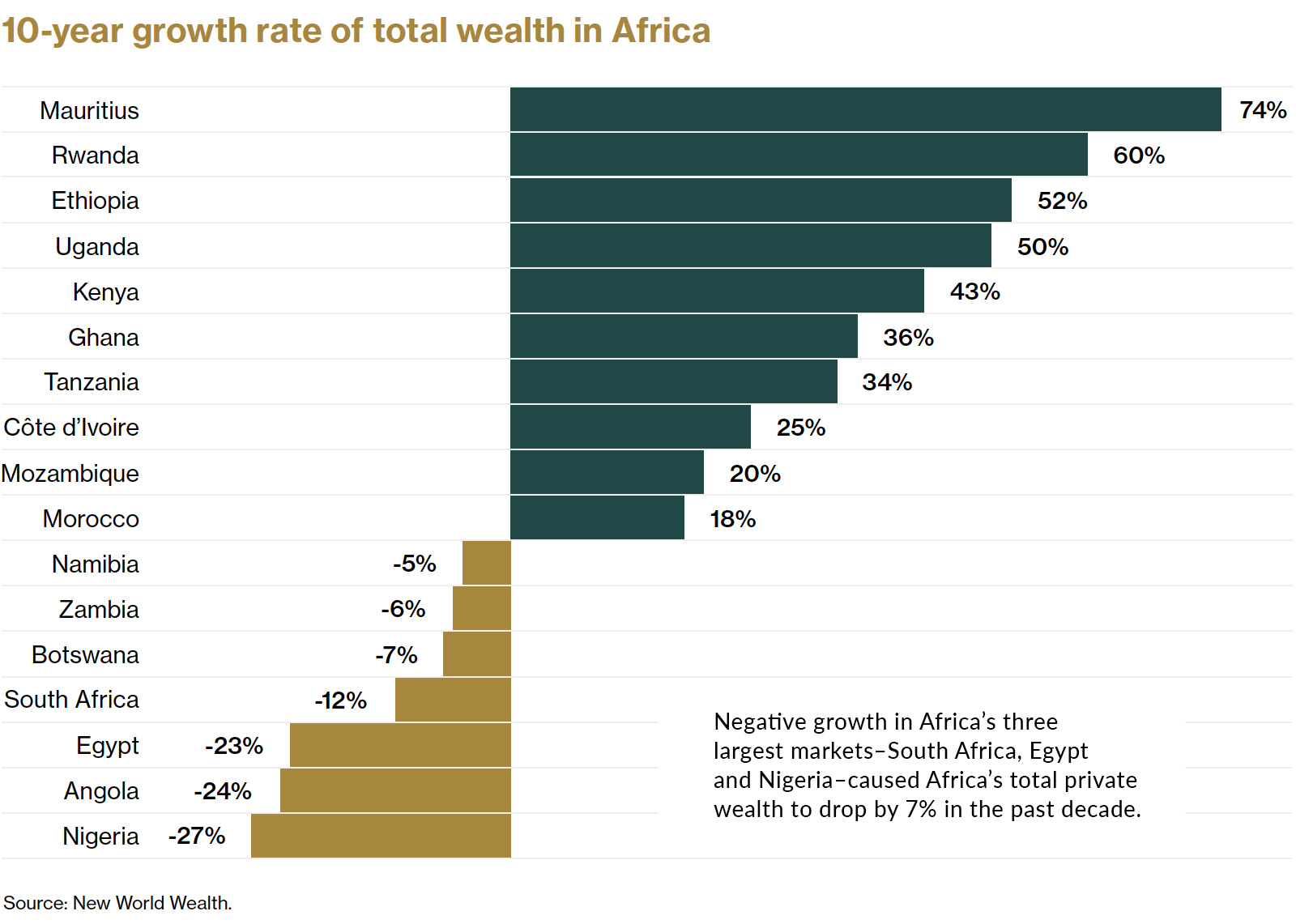

As a result, Mauritius has seen the strongest growth in total private wealth over the past decade, followed by Rwanda and Ethiopia.

On the flip side of the equation, Nigeria—which is Africa’s largest economy—saw a steep drop in total wealth. The country has struggled in recent years with high unemployment, corruption, and an over-reliance on crude oil.

The Big Picture

Over time, African countries are becoming less dependent on extractive industries, and business conditions are continuing to improve nearly across the board. These tailwinds, combined with the continent’s favorable demographics, point to a bright economic future for Africa.

The outlook for private wealth on the continent is largely positive as well. Total private wealth held in Africa is expected to reach US$3 trillion by 2031, an increase of close to 40%.

Markets

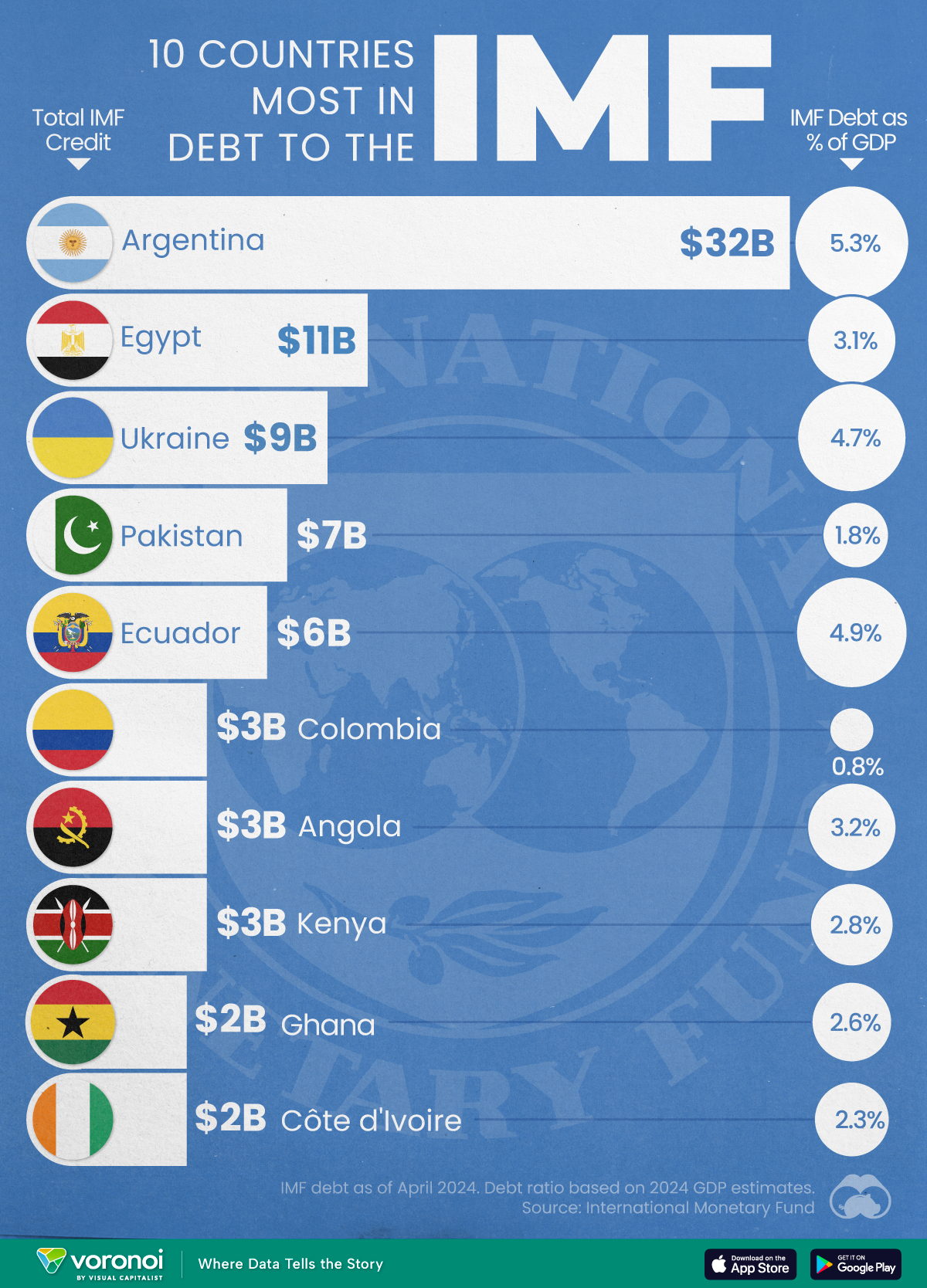

Top 10 Countries Most in Debt to the IMF

Argentina tops the ranking, with a debt equivalent to 5.3% of the country’s GDP.

Top 10 Countries Most in Debt to the IMF

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Established in 1944, the International Monetary Fund (IMF) supports countries’ economic growth by providing financial aid and guidance on policies to enhance stability, productivity, and job opportunities.

Countries seek loans from the IMF to address economic crises, stabilize their currencies, implement structural reforms, and alleviate balance of payments difficulties.

In this graphic, we visualize the 10 countries most indebted to the fund.

Methodology

We compiled this ranking using the International Monetary Fund’s data on Total IMF Credit Outstanding. We selected the latest debt data for each country, accurate as of April 29, 2024.

Argentina Tops the Rank

Argentina’s debt to the IMF is equivalent to 5.3% of the country’s GDP. In total, the country owns more than $32 billion.

| Country | IMF Credit Outstanding ($B) | GDP ($B, 2024) | IMF Debt as % of GDP |

|---|---|---|---|

| 🇦🇷 Argentina | 32 | 604.3 | 5.3 |

| 🇪🇬 Egypt | 11 | 347.6 | 3.1 |

| 🇺🇦 Ukraine | 9 | 188.9 | 4.7 |

| 🇵🇰 Pakistan | 7 | 374.7 | 1.8 |

| 🇪🇨 Ecuador | 6 | 121.6 | 4.9 |

| 🇨🇴 Colombia | 3 | 386.1 | 0.8 |

| 🇦🇴 Angola | 3 | 92.1 | 3.2 |

| 🇰🇪 Kenya | 3 | 104.0 | 2.8 |

| 🇬🇭 Ghana | 2 | 75.2 | 2.6 |

| 🇨🇮 Ivory Coast | 2 | 86.9 | 2.3 |

A G20 member and major grain exporter, the country’s history of debt trouble dates back to the late 1890s when it defaulted after contracting debts to modernize the capital, Buenos Aires. It has already been bailed out over 20 times in the last six decades by the IMF.

Five of the 10 most indebted countries are in Africa, while three are in South America.

The only European country on our list, Ukraine has relied on international support amidst the conflict with Russia. It is estimated that Russia’s full-scale invasion of the country caused the loss of a third of the country’s economy. The country owes $9 billion to the IMF.

In total, almost 100 countries owe money to the IMF, and the grand total of all of these debts is $111 billion. The above countries (top 10) account for about 69% of these debts.

-

Maps7 days ago

Maps7 days agoMapped: Southeast Asia’s GDP Per Capita, by Country

-

Markets2 weeks ago

Markets2 weeks agoVisualizing Global Inflation Forecasts (2024-2026)

-

United States2 weeks ago

United States2 weeks agoCharted: What Southeast Asia Thinks About China & the U.S.

-

United States2 weeks ago

United States2 weeks agoThe Evolution of U.S. Beer Logos

-

Healthcare1 week ago

Healthcare1 week agoWhat Causes Preventable Child Deaths?

-

Energy1 week ago

Energy1 week agoWho’s Building the Most Solar Energy?

-

Markets1 week ago

Markets1 week agoMapped: The Most Valuable Company in Each Southeast Asian Country

-

Technology1 week ago

Technology1 week agoMapped: The Number of AI Startups By Country