Energy Shift

The Largest Oil and Gas Companies in the World

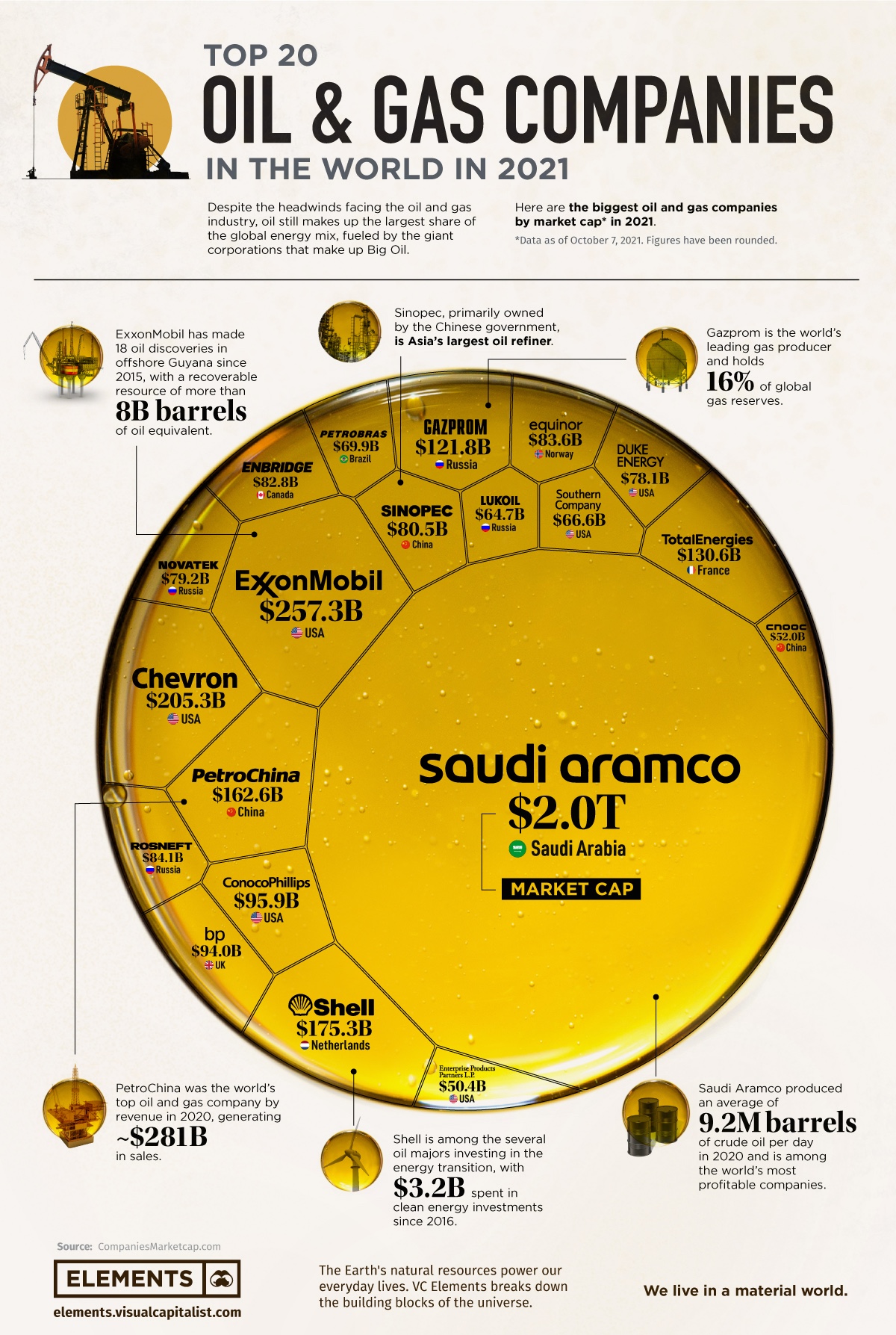

The Largest Oil & Gas Companies in 2021

The pandemic brought strong headwinds for the oil and gas industry, and oil majors felt the blow.

Global primary energy consumption fell by 4.5% relative to 2019 and oil demand declined by 9%. For a brief period in April 2020, the price of West Texas Intermediate (WTI) crude futures went subzero, marking the largest one-day price plunge since 1983.

Some expected the demand crash to have a lasting impact on the industry, but it’s safe to say that 2021 has proved otherwise.

Oil Resurfaces as Energy Crisis Deepens

The world is facing a shortage of energy, and peak winter is yet to hit most parts of the globe.

Pandemic-induced supply restraints from producers, in addition to rising energy demand from recovering economies, have sent nations scrambling for petroleum products. Consequently, oil prices are resurfacing to pre-pandemic levels.

As of today, prices of WTI crude futures are at their highest levels in the last five years at over $80 per barrel. Furthermore, U.S. natural gas prices hit a 7-year high of $6.5 per million British thermal units (BTU) earlier this month. Elsewhere, European benchmark natural gas futures have surged 1,300% since May 2020.

Of course, the largest oil and gas companies are riding this wave of resurgence. Using data from CompaniesMarketCap.com, the above infographic ranks the top 20 oil and gas companies by market cap as of October 7, 2021.

Big Oil: The Largest Oil and Gas Companies by Market Cap

Given that we often see their logos at gas stations, the largest oil and gas companies are generally quite well-known. Here’s how they stack up by market cap:

| Rank | Company | Market Cap* (US$, billions) | Country |

|---|---|---|---|

| 1 | Saudi Aramco | $1,979 | Saudi Arabia 🇸🇦 |

| 2 | ExxonMobil | $257.30 | U.S. 🇺🇸 |

| 3 | Chevron | $205.29 | U.S. 🇺🇸 |

| 4 | Shell | $175.28 | Netherlands 🇳🇱 |

| 5 | PetroChina | $162.55 | China 🇨🇳 |

| 6 | TotalEnergies | $130.56 | France 🇫🇷 |

| 7 | Gazprom | $121.77 | Russia 🇷🇺 |

| 8 | ConocoPhillips | $95.93 | U.S. 🇺🇸 |

| 9 | BP | $93.97 | U.K. 🇬🇧 |

| 10 | Rosneft | $84.07 | Russia 🇷🇺 |

| 11 | Equinor | $83.60 | Norway 🇳🇴 |

| 12 | Enbridge | $82.82 | Canada 🇨🇦 |

| 13 | Sinopec | $80.48 | China 🇨🇳 |

| 14 | Novatek | $79.18 | Russia 🇷🇺 |

| 15 | Duke Energy | $78.08 | U.S. 🇺🇸 |

| 16 | Petrobras | $69.91 | Brazil 🇧🇷 |

| 17 | Southern Company | $66.64 | U.S. 🇺🇸 |

| 18 | Lukoil | $64.70 | Russia 🇷🇺 |

| 19 | CNOOC | $52.04 | China 🇨🇳 |

| 20 | Enterprise Products | $50.37 | U.S. 🇺🇸 |

*As of October 7, 2021.

Saudi Aramco is one of the five companies in the trillion-dollar club as the world’s third-largest company by market cap. Its market cap is nearly equivalent to the combined valuation of the other 19 companies on the list. But what makes this figure even more astounding is the fact that the company went public less than two years ago in December 2019.

However, the oil giant’s valuation doesn’t come out of the blue. Aramco was the world’s most profitable company in 2019, raking in $88 billion in net income. Apple took this title in 2020, but high oil prices could propel Aramco back to the top in 2021.

Although Standard Oil was split up a century ago, its legacy lives on today in the form of Big Oil. ExxonMobil and Chevron—the second and third-largest companies on the list—are direct descendants of Standard Oil. Furthermore, Shell and BP both acquired assets from Standard Oil’s original portfolio on the road to becoming global oil giants.

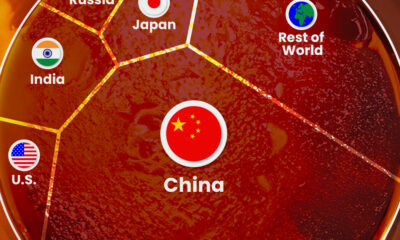

The geographical distribution of the largest oil and gas companies shows how global the industry is. The top 20 oil and gas companies come from 10 different countries. The U.S. hosts six of them, while four are headquartered in Russia. The other 10 are located in one of China, Brazil, Saudi Arabia, or Europe.

Big Oil, Bigger Emissions

Due to the nature of fossil fuels, the biggest oil and gas companies are also among the biggest greenhouse gas (GHG) emitters.

In fact, Saudi Aramco is the world’s largest corporate GHG emitter and accounts for over 4% of the entire world’s emissions since 1965. Chevron, Gazprom, ExxonMobil, BP, and several other oil giants join Aramco on the list of top 20 GHG emitters between 1965 and 2017.

Shifting towards a low-carbon future will undoubtedly require the world to rely less on fossil fuels. But completely shunning the oil and gas industry isn’t possible at the moment, as shown by the global energy crisis.

Energy Shift

Visualized: The Growth of Clean Energy Stocks

Visual Capitalist partnered with EnergyX to analyze five major clean energy stocks and explore the factors driving this growth.

The Growth of Clean Energy Stocks

Over the last few years, energy investment trends have shifted from fossil fuels to renewable and sustainable energy sources. Long-term energy investors now see significant returns from clean energy stocks, especially compared to those invested in fossil fuels alone.

For this graphic, Visual Capitalist has collaborated with EnergyX to examine the rise of clean energy stocks and gain a deeper understanding of the factors driving this growth.

Sustainable Energy Stock Performance

In 2023, the IEA reported that 62% of all energy investment went toward sustainable sources. As the world embraces sustainable energy and technologies like EVs, it’s no surprise that clean energy companies provide solid returns for their investors over long periods.

Taking the top-five clean energy stocks by market cap (as of April 2024) and charting their five-year cumulative returns, it is clear that investments in clean energy are growing:

| Company | Price: 01/04/2019 | Price: 12/29/2024 | 5-Year-Return % |

|---|---|---|---|

| First Solar, Inc. | $46.32 | $172.28 | 272% |

| Enphase Energy, Inc. | $5.08 | $132.14 | 2,501% |

| Consolidated Edison, Inc. | $76.55 | $90.97 | 19% |

| NextEra Energy, Inc. | $43.13 | $60.74 | 41% |

| Brookfield Renewable Partners | $14.78 | $26.28 | 78% |

But how does this compare to the performance of fossil fuel stocks?

When comparing the performance of the S&P Global Oil Index and the S&P Clean Energy Index between 2019 and 2023, we see that the former returned 15%, whereas the latter returned an impressive 41%. This trend demonstrates the potential for clean energy stocks to yield significant returns on an industry level, sparking optimism and excitement for potential investors.

A Shift In Returns

With global investment trends moving away from traditional, non-sustainable sources, the companies that could shape the energy transition provide investors with alternative opportunities and avenues for growth.

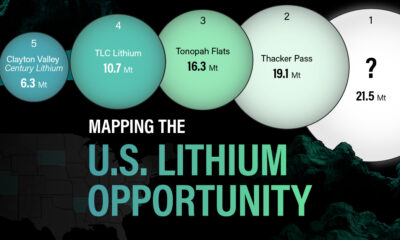

One such company is EnergyX. The lithium technology company has patented a groundbreaking technology that can improve lithium extraction rates by an incredible 300%, and its stock price has grown tenfold since its first offering in 2021.

Energy Shift

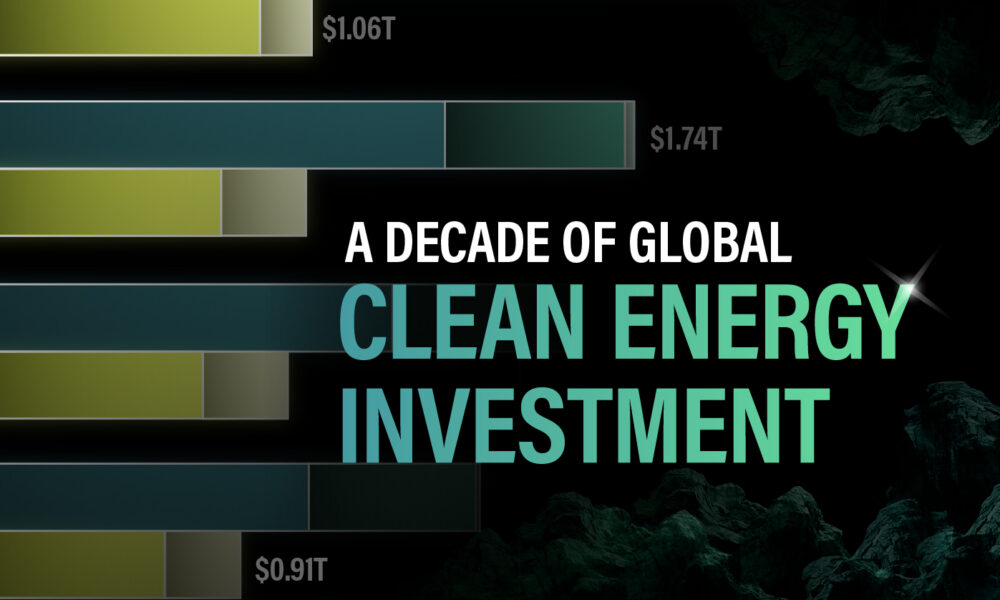

Visualized: A Decade of Clean Energy Investment

In this graphic, Visual Capitalist has partnered with EnergyX to explore the growth of global clean energy investment.

Visualized: A Decade of Clean Energy Investment

Global energy investment is growing every year. But recently, investments in clean energy have been significantly outpacing investments in fossil fuels.

For this graphic, we partnered with EnergyX to explore how global energy investment has changed and learn how investments in clean energy are starting to pay off for their investors.

The Rise of Sustainable Energy Investment

Propelled by various climate initiatives such as the Paris Agreement and the widespread adoption of EVs, global investment in sustainable energy surged to over $1.7 trillion in 2023, the highest ever, and the IEA projects that this growth could continue:

| Energy Product | 2020 | 2021 | 2022 | 2023 | 2030F |

|---|---|---|---|---|---|

| Clean Electrification | $0.97T | $1.05 | $1.21T | $1.34T | $1.65T |

| Low-Emission Fuels | $0.01T | $0.01 | $0.01T | $0.02T | $0.05T |

| Energy Efficiency | $0.28T | $0.35 | $0.39T | $0.38T | $0.49T |

| Clean Energy Total | $1.26T | $1.41T | $1.61T | $1.74T | $2.19T |

| Natural Gas | $0.26T | $0.27T | $0.31T | $0.32T | $0.35T |

| Oil | $0.42T | $0.48T | $0.52T | $0.55T | $0.60T |

| Coal | $0.16T | $0.16T | $0.18T | $0.18T | $0.11T |

| Fossil Fuel Total | $0.84T | $0.91T | $1.01T | $1.05T | $1.06T |

| Total Energy Investment | $2.10T | $2.32T | $2.62T | $2.79T | $3.25T |

Between 2020 and 2030, global investment in sustainable energy could increase by 74% to nearly $2.2 trillion, compared to just 26% additional investment in fossil fuels, with a forecast total of $1.06 trillion. This shows that sustainability is the future of energy investment.

Sustainable Investor Success Stories

While the growing investments in clean energy show that the world embraces sustainability, energy investors will still look for decent returns. Now, in 2024, clean energy investments are beginning to bear fruit. Here are just a few examples:

- Between 2019 and 2023, Tesla had a cumulative return of 1,073%

- NextEra Energy’s quarterly dividend increased by over 10% as of February 2024

- Investors in EnergyX have 10x’ed their investments since the company’s first offering in 2021

Lithium plays a critical role in powering electric vehicles (EVs) and facilitating the transition to sustainable energy. EnergyX has patented technology that enhances lithium extraction rates by up to 300%, contributing to meeting the growing demand for lithium and fueling the EVs of the future.

-

Electrification3 years ago

Electrification3 years agoRanked: The Top 10 EV Battery Manufacturers

-

Electrification2 years ago

Electrification2 years agoThe Key Minerals in an EV Battery

-

Real Assets3 years ago

Real Assets3 years agoThe World’s Top 10 Gold Mining Companies

-

Electrification3 years ago

Electrification3 years agoMapped: Solar Power by Country in 2021

-

Misc3 years ago

Misc3 years agoAll the Metals We Mined in One Visualization

-

Energy Shift2 years ago

Energy Shift2 years agoWhat Are the Five Major Types of Renewable Energy?

-

Electrification2 years ago

Electrification2 years agoThe World’s Largest Nickel Mining Companies

-

Misc3 years ago

Misc3 years agoThe Largest Copper Mines in the World by Capacity