In 2011, as the United States prepared to confirm a trade deal with Panama, senator Bernie Sanders raised a red flag.

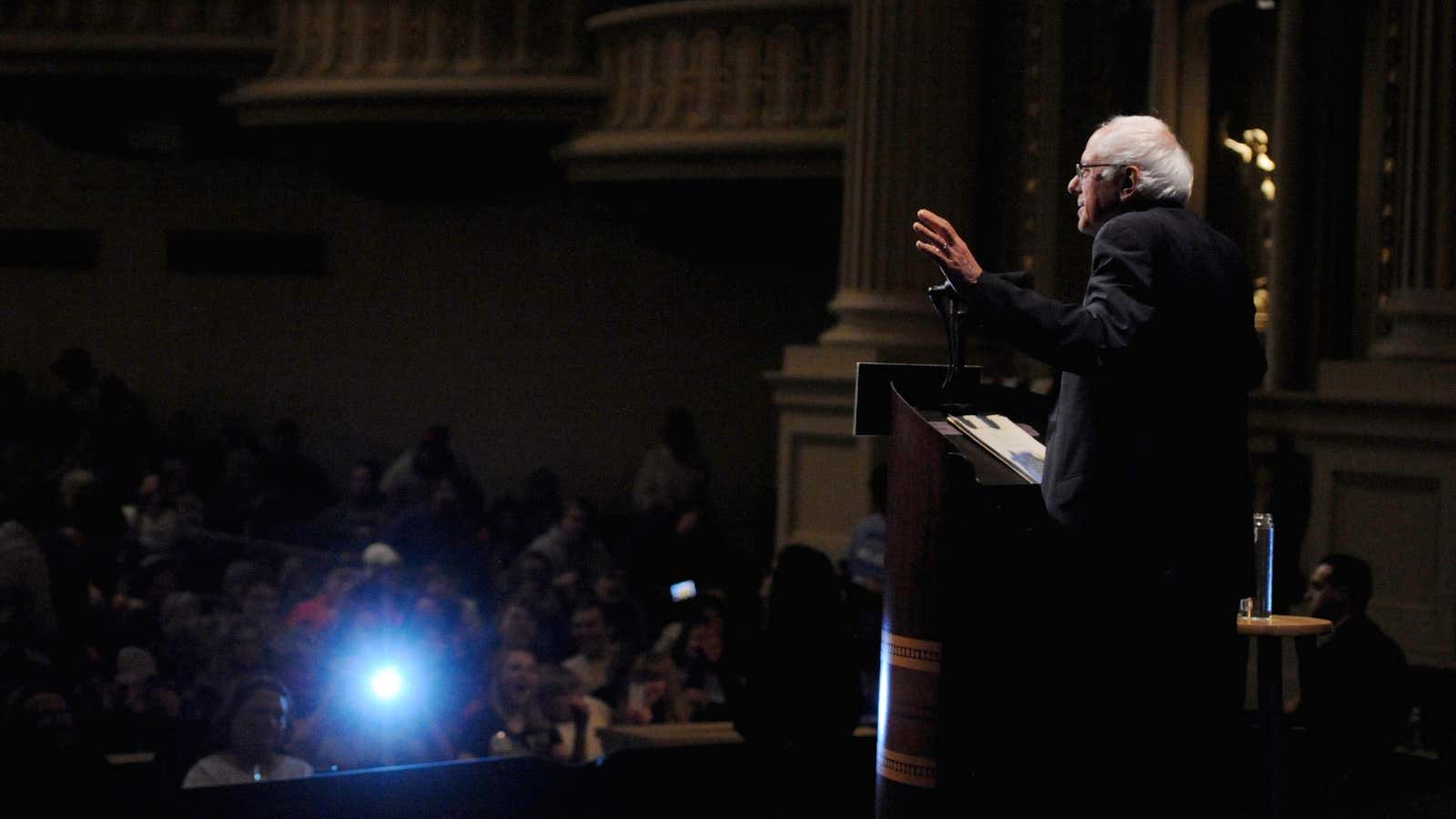

“Panama is the world leader when it comes to allowing wealthy Americans and large corporations to evade US taxes by stashing their cash in offshore tax havens,” he said in a speech on the Senate floor. “And the Panama Free Trade Agreement would make this bad situation much worse.”

“Each and every year, the wealthy and large corporations evade $100 billion in US taxes through abusive and illegal offshore tax havens in Panama and other countries,” he said.

With the leaking of the Panama Papers, which detail the offshore financial dealings of more than 214,000 companies and individuals from a Panamanian law firm, Sanders’s words have proved quite prescient. And it’s giving his campaign some ammunition against former senator Hillary Clinton, who voted to approve the trade deal.

“Sadly, Secretary Clinton made this tax evasion worse by supporting the Panama Free Trade Agreement in 2011, even though she opposed it when she was running for president against Barack Obama in 2008,” the Sanders campaign wrote on its Facebook page.

Still, it is far from certain that the Panama free trade deal actually made US tax evasion “worse.” There are almost no Americans mentioned in the Panama Papers leaks, though the journalistic investigation is ongoing.

Opponents of the agreement did argue that it bars limits on transfers of money between the United States and Panama, which takes a potential anti-money laundering measure off the table.

Panama has stringent bank secrecy laws and “a history of noncooperation with other countries on exchanging information about tax matters,” Rebecca Watkins, senior counsel with Citizens for Tax Justice, a nonpartisan nonprofit dedicated to improving US tax policy, told The Huffington Post in 2011.