Two Russian state institutions with close ties to Vladimir Putin funded substantial stakes in Twitter and Facebook through an investor who later acquired an interest in a Jared Kushner venture, leaked documents reveal.

The investments were made through a Russian technology magnate, Yuri Milner, who also holds a stake in a company co-owned by Kushner, Donald Trump’s son-in-law and senior White House adviser.

The discovery is likely to stir concerns over Russian influence in US politics and the role played by social media in last year’s presidential election. It may also raise new questions for the social media companies and for Kushner.

Alexander Vershbow, who was a US ambassador to Russia under George W Bush and to Nato under Bill Clinton, said the Russian state institutions were frequently used as “tools for Putin’s pet political projects”.

Vershbow said the findings were concerning in light of efforts by Moscow to disrupt US democracy and public debate. “There clearly was a wider plan, despite Putin’s protestations to the contrary,” he said.

The investments are detailed in the Paradise Papers, a trove of millions of leaked documents reviewed by the Guardian, the International Consortium of Investigative Journalists (ICIJ) and other partners, along with other previously unreported filings.

Facebook and Twitter were not made aware that funding for the investments came from the state-controlled VTB Bank and a financial arm of the state oil and gas firm Gazprom, according to Milner.

The files show that in 2011, VTB funded a $191m investment in Twitter. About the same time, Gazprom Investholding financed an opaque offshore company, which in turn funded a vehicle that held $1bn-worth of Facebook shares.

The money flowed through investment vehicles controlled by Milner, who in 2015 invested in a startup in New York that Kushner co-owns with his brother. Kushner initially failed to disclose his own holding in the startup, Cadre, when he joined Trump’s White House. A spokesman for Kushner declined to comment.

Milner once advised the Russian government on technology through a presidential commission chaired by Dmitry Medvedev, the former president and current prime minister. Now based in California’s Silicon Valley, Milner has invested $7bn in more than 30 online companies including Airbnb, Spotify and the Chinese retailers Alibaba and JD.com.

In a series of interviews, Milner said VTB’s funding did not buy it influence at Twitter. He said he was not aware that Gazprom Investholding had backed the stake in Facebook. Milner said the deals were a small part of his overall investment portfolio and were done when US-Russia relations were better.

Milner disputes that he is an associate of Kushner. He said he had invested in Kushner’s business purely for commercial reasons. He said they had met only once, over cocktails in the US last year. “I’m not involved in any political activity. I’m not funding any political activity,” said Milner.

The disclosure that stakes in two of the US’s biggest technology companies were financed by Russian entities with links to the Kremlin comes as the covert use of their platforms by Russians aiming to boost Trump’s 2016 presidential campaign is under intense scrutiny. Both VTB and Gazprom are now under US sanctions.

Though Milner said the investments had no connection to the controversy, the findings are likely to add to pressure on Facebook and Twitter to give a full and transparent account of their interactions with Moscow entities before and during the US election.

Vanessa Chan, a spokeswoman for Facebook, said the investment backed by Gazprom Investholding had been sold five years ago, after Facebook went public. Chan said Facebook “rejected the notion of a lack of due diligence” being done on its investors. A Twitter spokesperson said: “As a matter of policy Twitter conducted reviews of all pre-IPO investors.”

The Twitter and Facebook investments were made by Milner’s investment company DST Global, which was set up in 2009. At the time, Milner joined forces with the Russian oligarch Alisher Usmanov, a co-owner of Arsenal FC, who invested heavily in DST Global funds.

Purchases of Facebook and Twitter were public knowledge and turned out to be lucrative. Usmanov is estimated to have made more than $1bn on his original $200m stake. Usmanov sold the last of his Facebook holdings in September 2013 and Milner said DST Global had sold all stakes in Facebook and Twitter by 2014.

But the role of major state-run Russian banks in funding some stakes – including in Twitter, Trump’s favourite medium – was previously unknown.

Born in Soviet Moscow in 1961, Milner was named after Yuri Gagarin, who had become the first man in outer space earlier that year. Milner studied theoretical physics at Moscow State University and in 1990 moved from the Soviet Union to the US, where he attended the University of Pennsylvania’s Wharton School.

After a stint at the World Bank in Washington, he returned to Russia and set up Mail.ru, an email and social networking service, which became popular and profitable. In 2009, he was asked to join Medvedev’s innovation commission. Milner said the role involved advising Russian ministers and officials on moving public services online.

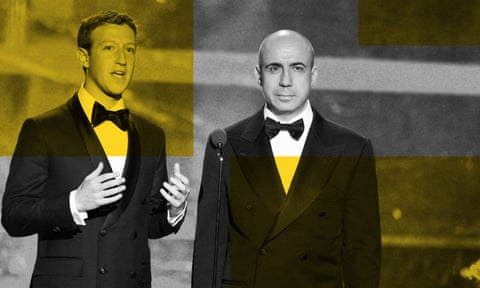

Facebook’s chief executive, Mark Zuckerberg, was so impressed with Milner’s rise that he invited the Russian to invest in Facebook. Milner’s company “stood out because of the global perspective they bring”, Zuckerberg said when announcing their first $200m deal in 2009. “I believe I had some expertise at the time that Mark found valuable,” Milner said.

The pair became friends and Zuckerberg attended Milner’s wedding in California late in 2011. The ceremony was held at a vast mansion atop a hillside near Silicon Valley that Milner had recently bought for $100m. Milner and Zuckerberg are advisers to each other’s philanthropic ventures and remain close.

Associates of Milner told the Guardian that he tried to secure funding for new investments from western banks. But they turned him down, forcing him after the 2008 financial crisis to go instead to Russian institutions. His exit from Moscow followed Putin’s return as president in 2012, as Russia moved in a more authoritarian direction. Milner has lived in the US with his family since 2014.

Milner said that as a management company, DST Global had sole discretion over its investment decisions. He said that he, like other investment managers, did not disclose the identities of his funders to the companies where DST Global invested. He said funders such as VTB received only basic updates on investments.

He briefly mentioned VTB’s role in the Twitter investment during an interview with Forbes magazine last month. The partial disclosure appeared to have been prompted by questions put to him by the Guardian and other media partners.

It is unclear if Moscow saw a political interest in funding stakes in Facebook and Twitter, or if the acquisitions were only intended to make money. Sources familiar with the situation told the Guardian that Facebook had carried out a discreet internal review of Russian investments before its IPO in 2012, and that the review was unable to draw firm conclusions.

Karen Vartapetov, the director of sovereign ratings at Standard & Poor’s, said the Russian government had “a strong influence on VTB’s strategic and business plans” even when these were not expected to be lucrative. “VTB plays a very important role for government policies, including implementation of some less profitable and socially important tasks,” said Vartapetov.

Russia’s role in exploiting Facebook and Twitter to influence the 2016 US election is an important strand of an FBI inquiry and congressional investigations. Facebook has identified 3,000 advertisements and 470 fake accounts on its network that were set up by a “troll factory” in St Petersburg. Details have been passed to Congress and to the special prosecutor, Robert Mueller, who is examining alleged collusion between the Trump campaign and Moscow.

VTB has a close relationship with the Kremlin and, according to analysts, has received more state subsidies than any other Russian bank. In 2009, the bank boasted that its investment banking arm was “pivotal in managing the state’s interests”.

VTB also has close ties to Putin’s FSB intelligence agency. The bank’s chairman, Andrey Kostin, is a former KGB foreign intelligence operative, it has been reported, who has received several state decorations from Putin. Milner denied knowing about VTB’s ties to Russian intelligence. VTB funded 45% of the Twitter stake. The bank denies Kostin worked for the KGB.

In an email, Milner’s spokeswoman said: “Yuri Milner has never been an employee of the Russian government.” Milner said he not spoken to Medvedev nor any other Russian minister about social media, and that he and Zuckerberg had not discussed the controversy over Russian exploitation of social media. “Politics is something I’m very uninterested in,” Milner told the Guardian.

‘They operate in the shadows’

The Paradise Papers help to unravel complex arrangements that led Russian state money to fund investments in the US social media companies.

They involve a bewildering array of companies using similar names and acronyms, some registered offshore in places that offer secrecy about ownership. The arrangements are legal, but have led campaigners to demand more transparency.

The trail begins in December 2005, when Gazprom Investholding began putting money into Kanton Services, a company registered in the British Virgin Islands. Usmanov was at the time general director of Gazprom Investholding, which the Kremlin has used to renationalise assets sold off in the 1990s.

Gazprom in effect took control of Kanton in 2009 in return for $920m. In 2011, Kanton in turn took a majority stake in DST USA II, a vehicle publicly associated with Milner. By 2012, DST USA II had bought more than 50m shares in Facebook, according to filings at the US Securities and Exchange Commission, amounting to more than 3% of the social media company.

Over the following months, ownership of DST USA II was transferred to an Usmanov company, which sold off $1bn worth of the shares in Facebook at a significant profit after the social network floated on the stock market.

The ultimate owner of Kanton was not made clear, but the company has several ties to Usmanov. An executive who dealt with Kanton on another deal, who requested anonymity to discuss private details, said: “I was led to believe this was one of Usmanov’s investment companies.”

Milner said he knew who owned Kanton but declined to name them, citing a confidentiality agreement. He said he did not know where Usmanov and his other partners obtained funding. “I had no knowledge of him using state funds to invest with us – he had enough funds already from the holdings that he owned,” said Milner.

Rollo Head, a spokesman for Usmanov, said in an email: “To be absolutely clear, Mr Usmanov did not borrow from or use state or quasi-state funds to make investments in Facebook.”

Alina Polyakova, a specialist in Russian foreign policy at the Brookings Institution in Washington, said Moscow frequently used intermediaries to ensure “plausible deniability” for the actions of senior officials.

“Russia’s influence over operations – whether that be allocating funds for disinformation campaigns or providing financing to extremist movements, or others – are intentionally opaque,” said Polyakova. “They operate in the shadows.”

The leaked documents, together with public filings, show that VTB funded another offshore investment vehicle, DST Investments 3, which was registered on the Isle of Man, a tax haven and UK crown dependency.

VTB put about $191m into this vehicle, which bought 11m shares in Twitter in 2011. When Twitter was preparing to float on the stock market in 2013, the VTB-funded vehicle held a 2% stake in the company. The VTB-funded stake was sold in May 2014, according to Milner. Stock prices from that time indicate the sale would have returned more than $240m in profit.

In July 2014, shortly before the US imposed sanctions on Russian entities such as VTB and Gazprom over the Kremlin’s aggression in Ukraine, control of DST Investments 3 was transferred to Kanton, the same company tied to Usmanov that was used as a go-between in the Facebook deal.

Milner insisted VTB had been treated like his other investors, but acknowledged it was different in one respect. “VTB Bank is clearly an institution controlled by the Russian government,” he said.

The Russian companies denied that their funding of the investments was politically motivated.

“The loans were provided for general corporate purposes,” said Oleg Maksimov, a spokesman for Gazprom Investholding. A VTB spokesperson said that in 2011 the bank “executed several deals in the high-tech industry, as we considered this field to have high potential” but had since sold its stakes.

Russian investor backed Kushner

The disclosure of Milner’s partial backing by Russian state interests may also cause difficulties for Kushner.

Milner in 2015 contributed $850,000 from his family trust to a $50m investment in Cadre, a New-York-based company that Kushner co-founded in 2014 with his brother, Joshua, and a friend of theirs from Harvard. The startup, which the Kushners claim is worth $800m, is based around an online marketplace where wealthy financiers can club together to invest in properties.

Cadre has attracted an estimated $133m of venture capital from backers including Peter Thiel, the controversial libertarian billionaire who co-founded PayPal and backed Trump’s campaign for president in 2016.

The company has already caused controversy for Kushner, after he initially failed to detail his stake in Cadre in financial disclosures to the US Office of Government Ethics. Kushner later added Cadre to revised paperwork, saying his stake in the firm was worth up to $25m.

Cadre initially said in a June press release that Milner’s stake in the company was held through his firm DST. A different version of the release on Cadre’s website said, however, that Milner himself was the investor in Cadre. The breakdown of the $50m funding was not made public by Cadre.

Milner said in an interview that he had invested in Cadre based only on the merits of the business. “I just thought it was an attractive opportunity,” he said.

He said he knew Joshua Kushner and had met Jared Kushner once, at a conference in Aspen, Colorado, in autumn 2016. “He was very pleasant and nice, and it was sort of a cocktail-type conversation,” said Milner, adding that politics was not discussed.

Cadre operates from the Puck Building in the Nolita section of Manhattan. The Kushners’ father, Charles, bought the building in the 1980s before being jailed for a string of crimes including 18 counts of tax evasion. The building, a red-brick Romanesque revival, was named after the 19th-century satirical magazine based there. A gilded Puck statue, wearing a top hat and tails, gazes down on staff as they arrive for work.

Mueller’s inquiry is believed to be reviewing Jared Kushner’s finances. Kushner was questioned by US senators in July about his connections to Russia. The closed-door session followed a series of explosive reports, including that Kushner had undisclosed contacts with Sergey Kislyak, then Russia’s ambassador to the US.

Quick GuideKey revelations from the Paradise Papers

Show

1) Millions of pounds from the Queen’s private estate has been invested in a Cayman Islands fund – and some of her money went to a retailer accused of exploiting poor families.

2) Prince Charles’s estate made a big profit on a stake in his friend’s offshore firm.

3) Extensive offshore dealings by Donald Trump’s cabinet members, advisers and donors, including substantial payments from a firm co-owned by Vladimir Putin’s son-in-law to the shipping group of the US commerce secretary, Wilbur Ross.

5) The tax-avoiding Cayman Islands trust managed by the Canadian prime minister Justin Trudeau’s chief moneyman.

6) The Formula One champion Lewis Hamilton avoided taxes on a £17m jet using an Isle of Man scheme.

7) A previously unknown $450m offshore trust that has sheltered the wealth of Lord Ashcroft.

8) Oxford and Cambridge and top US universities invested offshore, with some of the money going into fossil fuel industries.

9) The man managing Angola’s sovereign wealth fund invested it in projects he stood to profit from.

10) Apple secretly moved parts of its empire to Jersey after a row over its tax affairs.

11) How the sportswear giant Nike stays one step ahead of the taxman.

12) The billions in tax refunds by the Isle of Man and Malta to the owners of private jets and luxury yachts.

13) Offshore cash helped fund Steve Bannon's attacks on Hillary Clinton.

14) The secret loan and alliance used by the London-listed multinational Glencore in its efforts to secure lucrative mining rights in the Democratic Republic of the Congo.

15) The complex offshore webs used by two Russian billionaires to buy stakes in Arsenal and Everton football clubs.

16) Stars of the BBC hit sitcom Mrs Brown's Boys used a web of offshore companies to avoid tax.

17) British celebrities including Gary Lineker used an arrangement that let them avoid tax when selling homes in Barbados.

18) Prominent Brexit campaigners have put money offshore.

19) An ex-minister who defended tax avoidance has a Bahamas trust fund.

20) The Dukes of Westminster pumped millions into secretive offshore firms.

21) A tax haven lobby group boasted of 'superb penetration' at the top of the UK government before a G8 summit that was expected to bring in greater offshore transparency.

22) The law firm at the centre of the Paradise Papers leak was criticised for 'persistent failures' on terrorist financing and money laundering rules.

23) Seven Republican super-donors keep money in tax havens.

24) A top Democratic donor built up a vast $8bn private wealth fund in Bermuda.

25) The schemes used to avoid tax on UK property deals.

26) The celebrities, from Harvey Weinstein to Shakira, with offshore interests.

27) How a private equity firm tried to extract £890m from a struggling care home operator by making it take out a costly loan.

28) Trump’s close ally Robert Kraft, the New England Patriots owner, is the longtime owner of an offshore firm.

29) One of the world’s biggest touts used an offshore firm to avoid tax on profits from reselling Adele and Ed Sheeran tickets.

In remarks at the White House in July, Kushner said he had “not relied on Russian funds to finance my business activities in the private sector”.

Kushner attended a meeting at Trump Tower in June last year at which Donald Trump Jr was expecting to receive damaging information on Hillary Clinton, their Democratic opponent, which he was told had come from the Russian government. Kushner claimed he knew nothing about the meeting’s purpose before attending and left shortly after it began.

He has also denied reports that following his father-in-law’s election victory, he proposed setting up a secure communication channel between Trump’s team and Moscow to avoid snooping by the US before Trump took office. Kislyak reportedly told his superiors in Moscow, during conversations intercepted by American intelligence, that Kushner had asked for the backchannel during a meeting at Trump Tower last December.