Politics

The Year in News 2017, According to 2.8 Billion Tweets

The Year in News 2017, According to 2.8 Billion Tweets

One incredible thing about the big data era is that it allows us to crunch the numbers on pretty much anything.

Whether it’s analyzing a database of 50 million chess moves made during actual tournament gameplay, or developing a deep learning AI that sifts through billions of sensor inputs to learn how to drive a car with full autonomy – we can power nearly any analysis or algorithm with mountains of data.

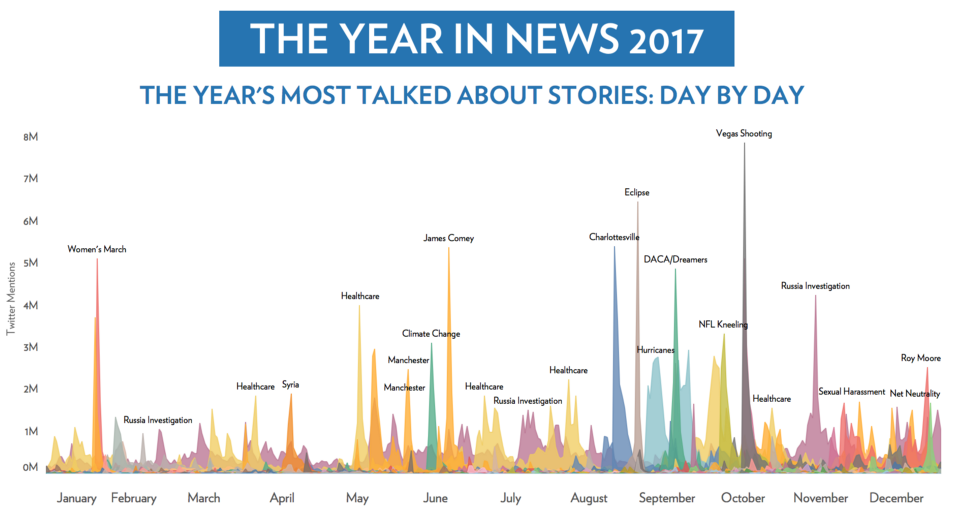

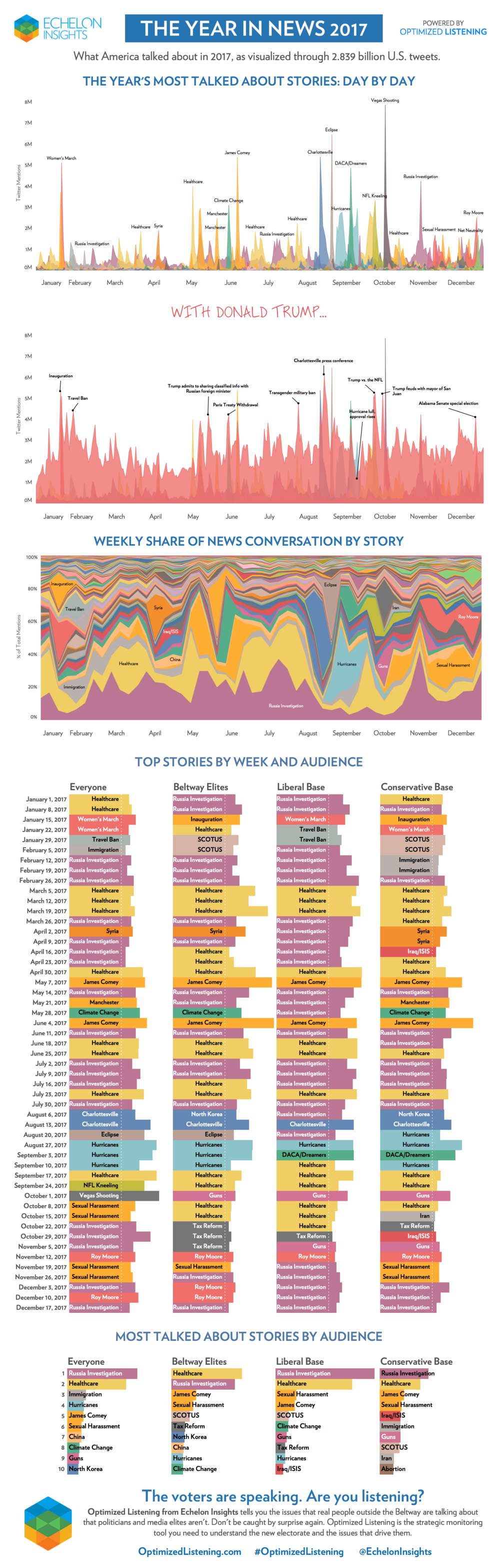

Like the above examples, today’s infographic from Echelon Insights uses massive amounts of data to paint a picture of the news that wasn’t possible 10 or 20 years ago. By analyzing the words in over 2.8 billion tweets, the end result is a convincing set of visualizations that showcase the most talked about topics over the course of 2017.

The Talk of 2017

Not surprisingly, the conversation in 2017 on Twitter revolved mainly around one person – and you may have heard of him.

I love Twitter…. it's like owning your own newspaper— without the losses.

— Donald J. Trump (@realDonaldTrump) November 10, 2012

According to Echelon Insights, Trump was mentioned 901.8 million times on Twitter in the United States over the duration of the year.

Here’s how that compares to some other notable politicians:

| Politician | Mentions in 2017 |

|---|---|

| Donald Trump | 901.8 million |

| Barack Obama | 164.2 million |

| Hillary Clinton | 123.2 million |

| Bernie Sanders | 48.8 million |

| Mike Pence | 31.4 million |

Trump was mentioned about 30x more often than his VP, and 7x more often than his one-time election opponent, Hillary Clinton.

And incredibly, Trump was the number one topic of daily conversation for 95% of the year, above every other issue and topic:

There were only 17 days in 2017 where Donald Trump was NOT the top topic of conversation, and he was the #1 story every week for every audience

– Echelon Insights, The Year in News 2017

But putting Trump aside, here are the specific narratives that received the most attention by users in the U.S. Twitterverse.

| Topic | Mentions in 2017 |

|---|---|

| Russia investigation | 180.4 million |

| Healthcare & Obamacare | 151.6 million |

| Immigration | 48.0 million |

| Hurricanes | 43.2 million |

| James Comey | 41.8 million |

| Sexual harassment scandals | 36.6 million |

| China | 36.2 million |

| Climate change & Paris Agreement | 31.8 million |

| North Korea | 28.2 million |

The Russia story dominated headlines on an ongoing basis.

The alleged collusion was a constant in the news cycle from February until August, and then it picked up again in November.

It was also the top story for two of the major groups that Echelon Insights tracks, the “Liberal Base”, as well as the “Conservative Base”. However, Russia was only the second most important story for the group “Beltway Elites”, falling behind the much-discussed topic of healthcare.

Economy

The Bloc Effect: International Trade with Geopolitical Allies on the Rise

Rising geopolitical tensions are shaping the future of international trade, but what is the effect on trading among G7 and BRICS countries?

The Bloc Effect: International Trade with Allies on the Rise

International trade has become increasingly fragmented over the last five years as countries have shifted to trading more with their geopolitical allies.

This graphic from The Hinrich Foundation, the first in a three-part series covering the future of trade, provides visual context to the growing divide in trade in G7 and pre-expansion BRICS countries, which are used as proxies for geopolitical blocs.

Trade Shifts in G7 and BRICS Countries

This analysis uses IMF data to examine differences in shares of exports within and between trading blocs from 2018 to 2023. For example, we looked at the percentage of China’s exports with other BRICS members as well as with G7 members to see how these proportions shifted in percentage points (pp) over time.

Countries traded nearly $270 billion more with allies in 2023 compared to 2018. This shift came at the expense of trade with rival blocs, which saw a decline of $314 billion.

Country Change in Exports Within Bloc (pp) Change in Exports With Other Bloc (pp)

🇮🇳 India 0.0 3.9

🇷🇺 Russia 0.7 -3.8

🇮🇹 Italy 0.8 -0.7

🇨🇦 Canada 0.9 -0.7

🇫🇷 France 1.0 -1.1

🇪🇺 EU 1.1 -1.5

🇩🇪 Germany 1.4 -2.1

🇿🇦 South Africa 1.5 1.5

🇺🇸 U.S. 1.6 -0.4

🇯🇵 Japan 2.0 -1.7

🇨🇳 China 2.1 -5.2

🇧🇷 Brazil 3.7 -3.3

🇬🇧 UK 10.2 0.5

All shifts reported are in percentage points. For example, the EU saw its share of exports to G7 countries rise from 74.3% in 2018 to 75.4% in 2023, which equates to a 1.1 percentage point increase.

The UK saw the largest uptick in trading with other countries within the G7 (+10.2 percentage points), namely the EU, as the post-Brexit trade slump to the region recovered.

Meanwhile, the U.S.-China trade dispute caused China’s share of exports to the G7 to fall by 5.2 percentage points from 2018 to 2023, the largest decline in our sample set. In fact, partly as a result of the conflict, the U.S. has by far the highest number of harmful tariffs in place.

The Russia-Ukraine War and ensuing sanctions by the West contributed to Russia’s share of exports to the G7 falling by 3.8 percentage points over the same timeframe.

India, South Africa, and the UK bucked the trend and continued to witness advances in exports with the opposing bloc.

Average Trade Shifts of G7 and BRICS Blocs

Though results varied significantly on a country-by-country basis, the broader trend towards favoring geopolitical allies in international trade is clear.

Bloc Change in Exports Within Bloc (pp) Change in Exports With Other Bloc (pp)

Average 2.1 -1.1

BRICS 1.6 -1.4

G7 incl. EU 2.4 -1.0

Overall, BRICS countries saw a larger shift away from exports with the other bloc, while for G7 countries the shift within their own bloc was more pronounced. This implies that though BRICS countries are trading less with the G7, they are relying more on trade partners outside their bloc to make up for the lost G7 share.

A Global Shift in International Trade and Geopolitical Proximity

The movement towards strengthening trade relations based on geopolitical proximity is a global trend.

The United Nations categorizes countries along a scale of geopolitical proximity based on UN voting records.

According to the organization’s analysis, international trade between geopolitically close countries rose from the first quarter of 2022 (when Russia first invaded Ukraine) to the third quarter of 2023 by over 6%. Conversely, trade with geopolitically distant countries declined.

The second piece in this series will explore China’s gradual move away from using the U.S. dollar in trade settlements.

Visit the Hinrich Foundation to learn more about the future of geopolitical trade

-

Economy18 mins ago

Economy18 mins agoEconomic Growth Forecasts for G7 and BRICS Countries in 2024

The IMF has released its economic growth forecasts for 2024. How do the G7 and BRICS countries compare?

-

United States1 week ago

United States1 week agoRanked: The Largest U.S. Corporations by Number of Employees

We visualized the top U.S. companies by employees, revealing the massive scale of retailers like Walmart, Target, and Home Depot.

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

We visualized product categories that saw the highest % increase in price due to U.S. inflation as of March 2024.

-

Economy4 weeks ago

Economy4 weeks agoG20 Inflation Rates: Feb 2024 vs COVID Peak

We visualize inflation rates across G20 countries as of Feb 2024, in the context of their COVID-19 pandemic peak.

-

Economy4 weeks ago

Economy4 weeks agoMapped: Unemployment Claims by State

This visual heatmap of unemployment claims by state highlights New York, California, and Alaska leading the country by a wide margin.

-

Economy2 months ago

Economy2 months agoConfidence in the Global Economy, by Country

Will the global economy be stronger in 2024 than in 2023?

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023