Money

Ranked: Who Are the Richest People in Africa?

Ranked: Who Are the Richest People in Africa?

The African continent is home to 46 billionaires, the second-lowest total of any global region.

The number of wealthy individuals in Africa is growing, however. Total private wealth is expected to rise 30% over the next decade, led by growth in the billionaire and millionaire segments.

Visualized here are Africa’s richest, using data collected by Forbes, on billionaires who reside on the continent and have their primary business there.

Breaking Down Africa’s Billionaires

The richest man in Africa is also the richest Black man in the world. Once a small sugar trader, Aliko Dangote now has a net worth of $13.5 billion. He is the 86th richest person in the world, and single-handedly makes up 25% of the total wealth of African billionaires.

His company, the Dangote Group is now an African conglomerate with interests in a range of sectors, including sugar, cement, and real estate.

| Rank | Name | Net Worth (billions, USD) | Industry | Citizenship |

|---|---|---|---|---|

| 1 | Aliko Dangote | $13.5 | Manufacturing | 🇳🇬 Nigeria |

| 2 | Johann Rupert & family | $10.7 | Fashion & Retail | 🇿🇦 South Africa |

| 3 | Nicky Oppenheimer & family | $8.4 | Metals & mining | 🇿🇦 South Africa |

| 4 | Abdulsamad Rabiu | $7.6 | Diversified | 🇳🇬 Nigeria |

| 5 | Nassef Sawiris | $7.3 | Construction & Engineering | 🇪🇬 Egypt |

| 6 | Mike Adenuga | $6.3 | Diversified | 🇳🇬 Nigeria |

| 7 | Issad Rebrab & family | $4.6 | Food & Beverage | 🇩🇿 Algeria |

| 8 | Naguib Sawiris | $3.3 | Telecom | 🇪🇬 Egypt |

| 9 | Patrice Motsepe | $3.2 | Metals & mining | 🇿🇦 South Africa |

| 10 | Mohamed Mansour | $2.9 | Diversified | 🇪🇬 Egypt |

| 11 | Koos Bekker | $2.6 | Media & Entertainment | 🇿🇦 South Africa |

| 12 | Strive Masiyiwa | $1.9 | Telecom | 🇿🇼 Zimbabwe |

| 13 | Mohammed Dewji | $1.5 | Diversified | 🇹🇿 Tanzania |

| 13 | Aziz Akhannouch & family | $1.5 | Diversified | 🇲🇦 Morocco |

| 13 | Youssef Mansour | $1.5 | Diversified | 🇪🇬 Egypt |

The top three—Alike Dangote, Johann Rupert, and Nicky Oppenheimer—account for 40% of the total wealth of those ranked.

A Look Through the Rest of the Richest People in Africa

At number two on the list is Johann Rupert. The chairman of Swiss luxury goods company, Compagnie Financiere Richemont, started his career with a banking apprenticeship in New York, before returning to South Africa and eventually pivoting to retail.

Through the rest of those ranked, a range of diverse business activities have allowed these billionaires to garner their wealth.

Nicky Oppenheimer (3rd) and Patrice Motsepe (9th)—have made fortunes in the mining industry, a sector which contributes nearly 10% to sub-Saharan Africa’s GDP. Meanwhile, Naguib Sawiris (8th) and Strive Masiyiwa (12th) have built telecom empires.

Billionaire Wealth Mirrors Country Wealth

Only seven out of the 54 African countries are represented on Africa’s rich list, and even amongst them, three countries (Egypt, South Africa, and Nigeria) account for more than two-thirds of the top-ranked billionaires.

| Country | Rank in African Economy | Individuals on Top 15 Billionaire List |

|---|---|---|

| 🇳🇬 Nigeria | #1 | 3 |

| 🇿🇦 South Africa | #2 | 4 |

| 🇪🇬 Egypt | #3 | 4 |

The home countries for these billionaires reflects the nations’ contribution to the African economy as a whole. Nigeria, South Africa, and Egypt have the top three GDPs in Africa.

Algeria—where Issad Rebrab (7th) is from—is ranked fourth, and Morocco—where Aziz Akhannouch (13th) is based—is fifth.

What’s Next For Africa’s Richest?

Africa has routinely been touted to become a future economic powerhouse as its demographic dividend pays off in the next few decades. However, its biggest challenge will be developing its economic and social infrastructure to retain local talent to make their fortunes at home.

Where does this data come from?

Source: Forbes.

Data note: Forbes calculated net worths using stock prices and currency exchange rates from the close of business on Friday, January 13, 2023. For privately held businesses, they used estimates of revenues or profits and applied prevailing price-to-sale or price-to-earnings ratios for similar public companies. Some list members grew richer or poorer within weeks or days of their measurement date.

Wealth

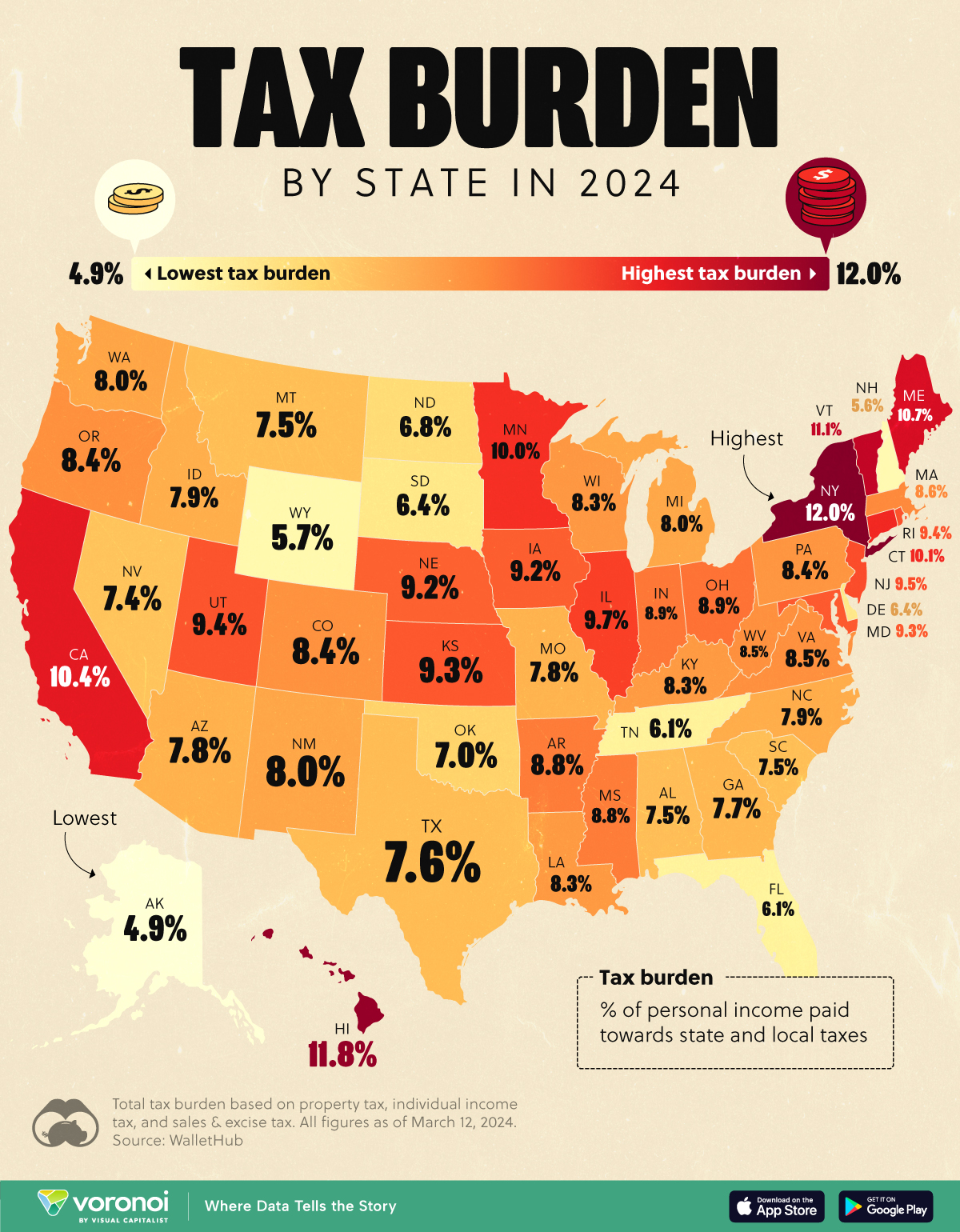

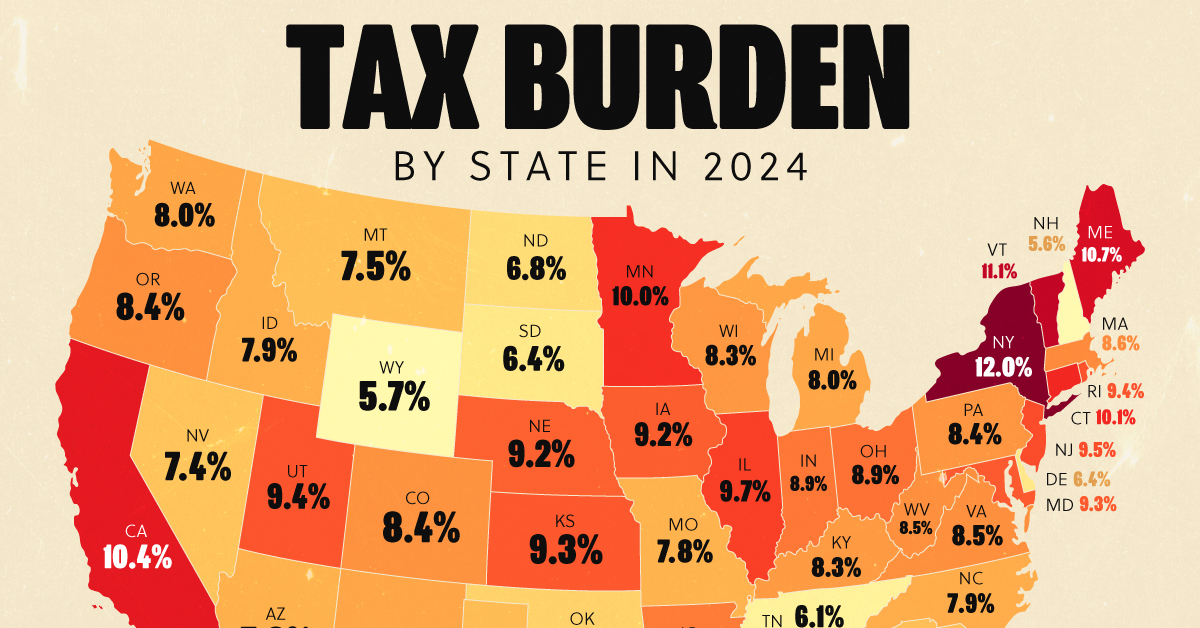

Visualizing the Tax Burden of Every U.S. State

Tax burden measures the percent of an individual’s income that is paid towards taxes. See where it’s the highest by state in this graphic.

Visualizing the Tax Burden of Every U.S. State

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This map graphic visualizes the total tax burden in each U.S. state as of March 2024, based on figures compiled by WalletHub.

It’s important to understand that under this methodology, the tax burden measures the percent of an average person’s income that is paid towards state and local taxes. It considers property taxes, income taxes, and sales & excise tax.

Data and Methodology

The figures we used to create this graphic are listed in the table below.

| State | Total Tax Burden |

|---|---|

| New York | 12.0% |

| Hawaii | 11.8% |

| Vermont | 11.1% |

| Maine | 10.7% |

| California | 10.4% |

| Connecticut | 10.1% |

| Minnesota | 10.0% |

| Illinois | 9.7% |

| New Jersey | 9.5% |

| Rhode Island | 9.4% |

| Utah | 9.4% |

| Kansas | 9.3% |

| Maryland | 9.3% |

| Iowa | 9.2% |

| Nebraska | 9.2% |

| Ohio | 8.9% |

| Indiana | 8.9% |

| Arkansas | 8.8% |

| Mississippi | 8.8% |

| Massachusetts | 8.6% |

| Virginia | 8.5% |

| West Virginia | 8.5% |

| Oregon | 8.4% |

| Colorado | 8.4% |

| Pennsylvania | 8.4% |

| Wisconsin | 8.3% |

| Louisiana | 8.3% |

| Kentucky | 8.3% |

| Washington | 8.0% |

| New Mexico | 8.0% |

| Michigan | 8.0% |

| North Carolina | 7.9% |

| Idaho | 7.9% |

| Arizona | 7.8% |

| Missouri | 7.8% |

| Georgia | 7.7% |

| Texas | 7.6% |

| Alabama | 7.5% |

| Montana | 7.5% |

| South Carolina | 7.5% |

| Nevada | 7.4% |

| Oklahoma | 7.0% |

| North Dakota | 6.8% |

| South Dakota | 6.4% |

| Delaware | 6.4% |

| Tennessee | 6.1% |

| Florida | 6.1% |

| Wyoming | 5.7% |

| New Hampshire | 5.6% |

| Alaska | 4.9% |

From this data we can see that New York has the highest total tax burden. Residents in this state will pay, on average, 12% of their income to state and local governments.

Breaking this down into its three components, the average New Yorker pays 4.6% of their income on income taxes, 4.4% on property taxes, and 3% in sales & excise taxes.

At the other end of the spectrum, Alaska has the lowest tax burden of any state, equaling 4.9% of income. This is partly due to the fact that Alaskans do not pay state income tax.

Hate Paying Taxes?

In addition to Alaska, there are several other U.S. states that don’t charge income taxes. These are: Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming.

It’s also worth noting that New Hampshire does not have a regular income tax, but does charge a flat 4% on interest and dividend income according to the Tax Foundation.

Learn More About Taxation From Visual Capitalist

If you enjoyed this post, be sure to check out this graphic which ranks the countries with the lowest corporate tax rates, from 1980 to today.

-

Markets5 days ago

Markets5 days agoVisualizing Global Inflation Forecasts (2024-2026)

-

Green2 weeks ago

Green2 weeks agoThe Carbon Footprint of Major Travel Methods

-

United States2 weeks ago

United States2 weeks agoVisualizing the Most Common Pets in the U.S.

-

Culture2 weeks ago

Culture2 weeks agoThe World’s Top Media Franchises by All-Time Revenue

-

voronoi1 week ago

voronoi1 week agoBest Visualizations of April on the Voronoi App

-

Wealth1 week ago

Wealth1 week agoCharted: Which Country Has the Most Billionaires in 2024?

-

Business1 week ago

Business1 week agoThe Top Private Equity Firms by Country

-

Markets1 week ago

Markets1 week agoThe Best U.S. Companies to Work for According to LinkedIn