If you said China, you’ve been paying attention.

Many governments maintain export credit agencies to help their countries’ firms export goods, akin to the kind of in-house lender you might find at an automaker, but with the public providing the initial capital. The idea is to make your exports more competitive by providing cheap financing. In the United States, a debate is now raging over this concept because conservatives in Washington are mounting a concerted effort to kill the Export-Import Bank of the United States, calling it an example of crony capitalism.

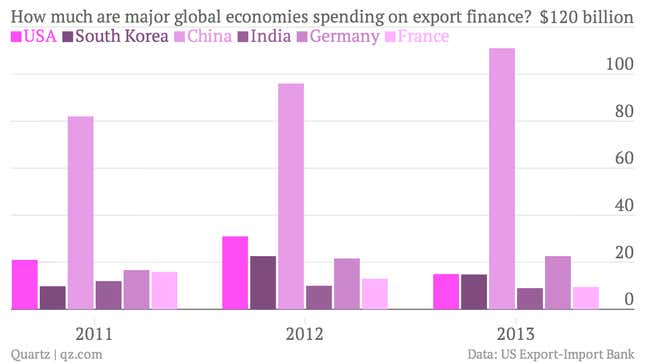

Many liberals agree, and even President Obama felt this way during his first presidential campaign. But now his administration is joining the business lobby in an attempt to protect the bank. That probably has something to do with the chart above: With Washington lawmakers in gridlock, he has few tools to improve US global competitiveness, and the $36 billion in loans made on behalf of companies last year helped support US jobs and businesses—filling some of the economic gap left by the lack of a targeted fiscal policy or other reforms. The billions in profits the bank annually returns to the US Treasury don’t hurt either.

Boosting trade has been a key part of Obama’s post-crisis growth plan, and that of a lot other big economies who see mercantilist strategies paying off: China pumps huge amounts of money into its export finance as it seeks to surmount the US as the globe’s top economy, and China’s credit is tightly connected to its foreign policy agenda (just as the US Ex-Im bank was when it helped fund the Marshall Plan after World War II). Germany (which has issued almost exactly as much credit as the US in the last seven years) and South Korea are two other big exporters who have deployed significant amounts of credit financing to help boot trade.

Still, it’s not clear how integral the bank is to US export success. It is clearly a big part of Boeing’s international sales plan (about 65% of the bank’s funding goes to the airline giant) and it helps fund exports (and jobs) at many small businesses around the US, who say they’d be lost (paywall) without the force multiplier provided by its financing. But its annual loans make up a negligible portion of US trade—last year the loans it guaranteed were equal to 1.6% of all US exports.

The current fight remains unresolved; the analysts at the political risk consultancy the Eurasia Group are betting that the bank’s mandate will expire at year’s end and perhaps be renewed next year with new conditions and limits. But lobbyists for the business groups behind the bank are confident that they can convince enough lawmakers of the bank’s value to their constituents to keep American export finance alive. To do so, they’ll need to convince Republican leaders to bring the bill to the floor over the objections of the conservatives in their caucus—and there’s no guarantee that will happen.